President Donald Trump’s “One Big Beautiful Bill,” passed on July 3, 2025 by a vote of 51-50, with Vice President J.D. Vance breaking the tie. On July 4, it was signed into law.

No matter which way you slice it, this bill will have impacts on nearly every Michigander. So today, I want to cut through the noise, break down exactly what’s in this bill, and help Michiganders prepare.

Here’s the topline: This bill is bad for Michigan, and bad for working Americans. It cuts healthcare or will likely make your insurance more expensive. It cuts food assistance to seniors, veterans, and children. It makes higher education less affordable for families. And it will likely increase your electricity bills.

The bill does all of this primarily to make tax cuts permanent for the wealthiest tax brackets. There are a few tax promises for middle class folks, but these are temporary, and will expire in just three years.

For those Michiganders on service programs—if you have a Bridge Card; or if you’re on Michigan Medicaid or the Healthy Michigan Plan; or if you have a plan from the health care marketplace—you'll need to keep an eye out for significant changes, and significant costs, coming your way. For everyone else, the cuts in the safety net programs, combined with other major policy changes, are likely to make your household costs go up, starting as early as January 1, 2026.

Below I’ve listed out some specific dates and changes you should be watching for. Some of them kick in sooner than others, but all of them are important—because hospitals, insurance companies, energy companies, and the state of Michigan are already starting to factor in this new bill as they determine services and prices for 2026.

HEALTH CARE

This bill will affect every single American’s healthcare—either by kicking you off your insurance, or making you pay more for it, or making care harder to get.

If you get coverage through the Affordable Care Act marketplace, or what’s commonly called Obamacare—plans from companies you know, like Blue Cross Blue Shield of Michigan or Priority Health—here are some important changes you should be tracking:

- November 1, 2025—Open Enrollment begins. If you’re shopping for a health care plan on the marketplace, this is when you’ll start seeing higher premiums for plans that start January.

- Who will this affect? Almost every one of the roughly 500,000 Michiganders who get coverage through the marketplace, but especially folks who live above the poverty line but are not super wealthy. A family of four making $129,000 a year will pay an estimated $5,500 more in health care every year because of this bill. A 60-year-old couple making $82,000 a year will see an estimated $13,000 in higher costs.

- Here is a handy calculator where you can plug in your information and see what this bill will do to your healthcare costs, if you have a marketplace plan.

- January 1, 2028—Affordable Care Act plans effectively stop auto-renewing. Starting in 2028, you will have to start affirmatively re-enrolling every year to keep your healthcare. This gives you more hoops to jump through in order to actually receive the marketplace coverage you qualify for and will result in fewer people covered by insurance that the government helps pay for.”

If you’re on Medicaid, particularly the Healthy Michigan Plan, which roughly 600,000 Michiganders are currently on, here are some important changes you should be tracking:

- Beginning no later than January 1, 2027—individuals between 19 and 64, including parents with kids ages 14 and up, will have to prove 20 hours of work, school, job training, or other such activities a week to qualify for healthcare. You should be watching MDHHS very closely for updates on these requirements.

- As of that same date—you will need to recertify eligibility at least every six months. Currently, you recertify once a year; Medicaid patients will need to reprove eligibility at least twice a year. This is designed to ensure that people forget or miss deadlines, so that less people stay on Medicaid.

- October 2028—you'll start seeing higher copays for services. Instead of $0 or $1 or $3, you’ll see up to $35 copays for most services.

Even if you don’t get coverage through Medicaid or the ACA, you could see facilities close, and your costs go up.

- One way or another, this bill means higher costs for everyone – no matter how you get your coverage. Providers and insurers are looking at their books today to figure out how they will deal with this trillion-dollar hit to our healthcare system – and it won’t be by eating these cuts themselves.

- A new report from the Michigan Department of Insurance and Financial Services estimates that nearly a million Michiganders will see their premiums go up by nearly 17 percent. This includes major insurers like Blue Cross Blue Shield of Michigan and Priority Health.

- The dollar amount will vary based on how much you pay for your premiums. But the average family pays roughly $6,000 a year for an employer-sponsored health plan. A 17 percent increase could mean that same family would see a $1000 increase in cost for their plan.

- These changes would take effect January 1, 2026, so please look for updates this fall from your insurance company.

Facilities around you could start scaling back services, or even close their doors.

- The Michigan Health & Hospital Association predicts this bill will cost hospitals across the state more than $6 billion over ten years. This is because starting in 2027, the bill guts a critical revenue stream that states use to fund Medicaid services and expansion (what’s called the “provider tax”). These kinds of losses are simply not sustainable for many small and rural hospitals, who may be forced to reduce services or close their doors. Hillsdale Hospital, as an example, has already announced that they stand to lose up to $6 million annually.

- There are over 400 Community Health Centers in Michigan—like Cherry Health in Grand Rapids and Great Lakes Bay in Saginaw—that rely mostly on Medicaid reimbursement. Centers like these are at significant risk of scaling back community services. Statewide, more than 40% of these community health centers could close.

And in this bill, Planned Parenthood is specifically targeted, because it is effectively cut off from Medicaid payments for all centers for the next year. This provision is tied up in courts, but defunding Planned Parenthood means cutting off women’s access to screenings for cancer and sexually transmitted infections, OB-GYN appointments, and family planning resources to have healthy pregnancies. This isn’t about abortion; existing law already states that Medicaid funds cannot be used to pay for abortions in nearly all cases. We are watching this closely and will keep you updated.

FOOD ASSISTANCE

This bill makes it harder to qualify for food assistance. It also hurts our grocery stores, particularly in rural communities.

If your family receives SNAP benefits—also known as food stamps, or in Michigan the Bridge Card—here are some important dates and changes you should be tracking:

- Likely by October 1, 2025 (or earlier)—new work requirements for people 54-64 and parents with kids 14 and older. This is a big change from before, when people over 54 and parents were exempt. Similar to Medicaid, you must prove that you completed 20 hours a week, or 80 hours a month, of work, education, job training, or volunteer service. Details should be updated on the MI Bridges website. But if you want to get in touch with MDHHS in the meantime, you can contact your local office here.

- Beginning October 1, 2027—you might see your Bridge Card benefits cut regardless of work requirements. This is the date that many states must begin paying more for food assistance programs, as federal funding cuts take effect. We are still waiting to see how these cuts impact coverage and services in Michigan, and will keep you updated.

Even if you do not have a Bridge Card, you’ll probably still see the effects of these cuts.

- Grocery stores, particularly small-town or rural stores, might be forced to cut hours for employees or shut down. Store owners are also worried about increased food theft and violence against cashiers and floor workers—a real risk when people are desperate.

- And if Michigan continues funding SNAP fully, they might have to pull from other areas, like public health or education.

STUDENT LOANS

This bill makes higher education, particularly for four-year colleges and graduate degree program, less accessible for middle-class Americans. It cuts and caps options for federal student loans, which has been a huge factor in helping middle-class people get undergraduate and graduate degrees.

The main date you should know for student loans is July 1, 2026. This is when your options for federal loans start to change, which primarily affects students applying to four-year colleges and graduate school programs. That means students applying this fall, to start in Fall 2026, will be the first to really get hit.

- For Parent PLUS—this is for parents who take out loans to help their kids afford college. Until now, the maximum loan was based on a school’s total yearly cost of attendance minus any other financial assistance a child receives. Under this bill, Parent PLUS loans are capped at $20,000 a year, up to $65,000 over a lifetime for each kid. For context, Michigan State lists their estimated undergraduate cost of attendance for 2025-2026 at roughly $35,000 for in-state students and $65,000 for out-of-state students.

- For graduate loans—there are fewer options, and more caps on how much students can borrow, for their degrees. Originally, you could borrow from the federal government up until the cost of attendance minus any other forms of financial assistance you receive.

- Now, for a master’s degree, like a Master’s in Public Health or a teaching degree—you can only take out $20,500 a year, up to $100,000 over a lifetime. This would severely hamper students’ ability to attend even in-state public universities; the University of Michigan, for example, charges $36,000 per year, just for tuition for Master’s in Public Health students, not including cost of living or textbooks.

- For a professional degree—law school or medical school—you can take out $50,000 a year, up to $200,000 over a lifetime. For context, the average cost of attendance for even in-state, public medical schools in the US is just over $71,000 a year, or $286,000 total. We already have a doctor shortage in Michigan, and these loan changes could make that shortage worse.

- If you’re hoping to go to grad or professional school, or help your kids afford college, you might have to take out private loans to cover the full cost of attendance—which can have predatory terms, higher rates, and leave you drowning in debt.

ENERGY

As we all know, demand for energy is going up — and is scheduled to go WAY up over the next 5-10 years. Unfortunately, this bill will reduce energy supplies just as demand is going up—and is therefore at real risk of raising your electricity bills in the next few years.

Here are some important dates:

- September 30, 2025—the $7,500 tax credit for electric vehicles expires. If you are in the market for an electric vehicle, I would suggest getting to the dealership as soon as possible, sometime in the next two months.

- January 1, 2026—reimbursements and tax credits for residential clean energy will be fully phased out. If you are planning to make any energy-efficient improvements on your home, like installing solar panels, heat pumps, or energy efficient windows and doors, you should plan for those to be completed by the end of the year. Updates should soon be available at IRS.gov, so keep an eye out for further information.

- January 1, 2028—federal government investments in large-scale solar and wind projects will be fully phased out. Projects must either start construction by July 4, 2026 or start producing electricity by December 31, 2027, to qualify at all. This will impact ongoing solar and wind projects in Michigan, and the jobs associated with those projects: Companies like Groveland in the Upper Peninsula and CBS Solar, a family-owned local business in Copemish, are already evaluating how these changes will impact construction and completion of these planned projects. Check in with your local solar and wind project for any adjusted plans.

Based on the energy changes in this bill, it almost certainly will raise costs and destroy jobs.

- Before the Big Beautiful Bill passed, electricity bills for American households were actually expected to go down over the next ten years because of tax credits for clean energy projects. Now, based on early studies from the think tank Energy Innovation, American families will likely be paying more—roughly $160 more by 2030, and roughly $320 more by 2035.

- It’s also possible Michigan could start seeing more blackouts and brownouts as projects close down. In a recent report from the Department of Energy, the Trump Administration themselves admit that we are running low on energy—and that blackouts could become 100 times more common by 2030.

- And with the loss of wind and solar projects comes the loss of jobs. According to Energy Innovation, 19,000 Michigan jobs could lost by 2035, as factories close and construction halts.

TAXES

A few of the bill’s tax cuts are good for working Americans. But we are concerned that whatever gain comes from tax relief will be eaten up by higher health care and food costs. Also, it’s important to note: the tax provisions that are good for working Americans are temporary, set to expire in the next three years. Tax cuts that benefit the wealthiest Americans, on the other hand, are now permanent.

Overall, this bill did not change individual tax rates. It extended current tax cuts with no changes to individual rates. So in terms of your actual return, you likely won’t see much change in your federal tax return on income alone, assuming your specific situation remained the same.

This bill makes permanent or expands tax breaks that will result in much higher gains for high-earners in comparison to working and middle-class families. This includes bigger estate tax cuts for wealthy heirs, business deductions for corporations, and a low corporate tax rate. The average Michigander will also be able to deduct taxes on tipped and overtime income. However, it’s important to note that the deductions for tips and overtime expire in three years, while benefits to corporations and wealthy Americans are permanent.

This bill also increases your outside costs—because it significantly cut government spending for things like healthcare, food assistance, education, and student loans. So for example, if you rely on programs like Medicaid and SNAP, or if you get your healthcare through the Marketplace, or if your private health plan becomes more expensive due to huge Medicaid cuts, you will feel the hit to your family budgets—particularly if you’re making $96,000 and below.

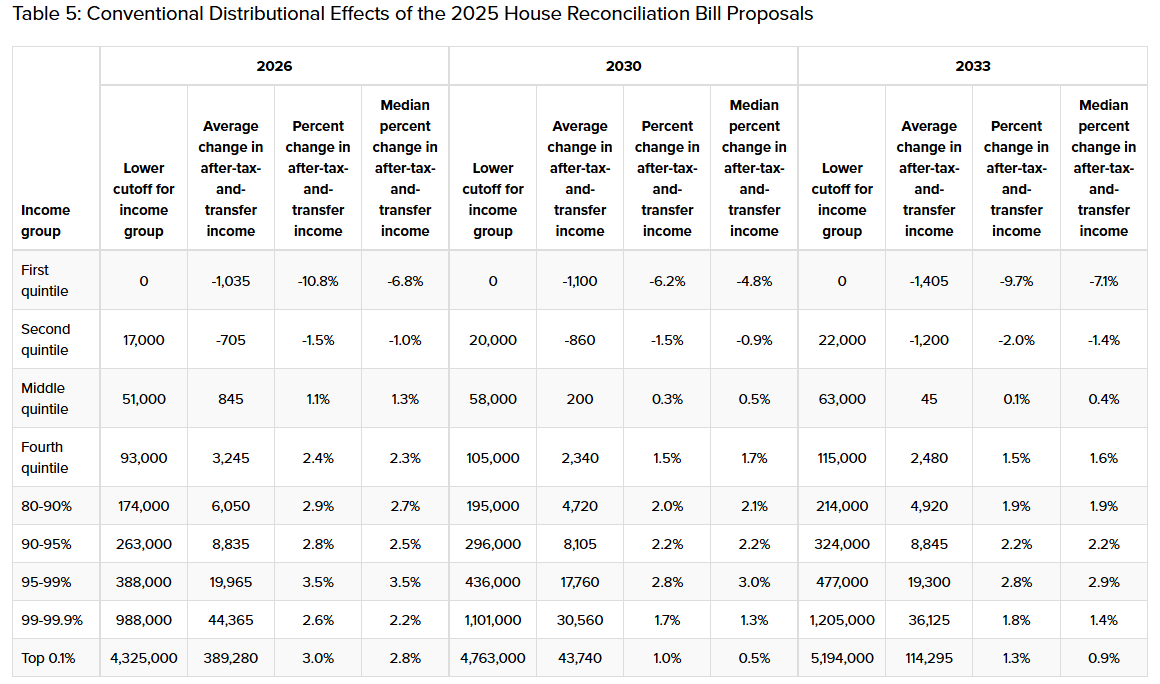

This means that the higher your gross income, the more gains you will see from this bill—and the lower your income, the higher your costs will be, even if your tax return stays the same. And while working Americans may see bumps, it’s the wealthiest Americans—especially annual salaries in the millions—who will disproportionately benefit from these tax cuts.

Below are rough estimates for what you can expect for your budgets in the next ten years, based on your income. (Click on it to expand.)

Source: Penn Wharton Budget Model

- If you make under $18,000 a year, you’ll almost immediately start losing money due to likely reliance on social programs. If your income and circumstances stay the same, you should see roughly the same amount in your refund for your 2027 taxes. However, your overall cost of living—particularly if you’re on programs like Medicaid and SNAP—will likely go up significantly, due to drastic changes to those programs. Your costs could go up as much as $160 a year in 2027, and as much as $1,300 in 2033.

- If you make under $53,000 a year, your budget might look the same as it does now in 2027. But in the long run, you’ll almost certainly lose money—as much as $1,500 by 2033. This is because you’ll have to pay more to cover things that the government currently helps support—Medicaid and SNAP if you qualify, or healthcare you get on the ACA Marketplace, which the government helps keep low so more people can afford it.

- If you make over $53,000 but under $96,000, you might start to see a bump in 2027—as high as $1,400. But those gains will slowly decrease over time—and in 2033, you’re predicted to be losing $65 on average.

- If you make $96,000 to $272,000 a year, you’ll gain back $4,000 to $7,000 a year. This bracket is quite wide and very individualized. Refer to the chart above for specifics.

- Starting with incomes around $272,000 a year, you will definitely be making more money back—starting at roughly $10,000 a year. And the higher your income, the bigger tax break you'll get. If you’re making $5 million a year, for example, you’ll be getting back roughly $300,000 in tax breaks next year alone.

Here’s what you can expect if you make money from tips and overtime. Note that many details are still taking shape – the bill left some important specifics up to the Trump Administration, and those specifics have not been announced.

Here are the specifics for No Tax on Tips:

- You can deduct up to $25,000 of qualified tips from your federal income taxes. If you make more than $25,000 in tips, you will still have to pay normal income taxes on anything above $25,000.

- You must work in a specific occupation defined by the Secretary of the Treasury—a list that has not yet been released. These professions will likely be ones that traditionally receive tips—think servers, bartenders, hair stylists, and nail technicians. Other jobs like cooks, dishwashers, and other back-of-house staff are likely not eligible. We are waiting for guidance from the Secretary of the Treasury on who will qualify, and will keep you updated.

Here are the specifics for No Tax on Overtime:

- You can deduct up to $12,500 in overtime taxes if you file alone, or $25,000 if you file jointly.

- You do not have to itemize your deductions to claim this tax break.

A few basic requirements to qualify for both tax credits:

- You must have a Social Security Number.

- This is not an exemption of taxes on all tips, but a deduction of your tips up to a certain amount. More specific details on overtime and tip deductions below.

- You cannot make more than $150,000 if you are filing alone, or $300,000 as a joint filer, to receive the full benefit. This credit phases out if you exceed these income limits.

- You are still required to pay a payroll tax. So despite the new credits, you will still pay some federal taxes on your tipped and overtime earnings.

- You may only claim these credits through 2028. After 2028, the credits disappear, and your tipped and overtime income will be taxed the same as it is now.

Note that exact numbers are still taking shape, and economists are still working on analysis for how this bill will change your costs. Above are the most updated estimates we have—though note that they will vary widely based on your unique tax situation—whether you have dependents, if you own a small business, if you have student loans, if you have tipped or overtime income, and so on. We will continue to update you once we have more precise, updated information.

For more information, a few organizations have released calculators where you can plug in your specifics and see how much your taxes will change. TurboTax is working on a custom generator specifically for understanding the tax pieces of the new law for individuals, families, and businesses—the generator is not out yet, but they do have some scenarios already available. As other organizations begin to release estimates and calculators, we’ll be sure to keep you updated on how your taxes will look for 2026 and beyond.

OVERALL

Bottom line: We fought really hard to make sure this bill didn’t pass. It is now law. But that doesn’t mean that we’re done fighting. As more analysis and details come out, we’re keeping tabs on how this bill affects you and your loved ones in the coming months. And we want to hear from you—real stories, from real Michiganders like you, on how this bill is affecting you. These stories are important. Your voice matters. And we’re listening.

And as always, I want to make sure you know how to reach me and my team if you need help with anything. We can assist with anything from federal agency issues. We can be your voice and your advocates within the federal government, and of course if a legislative fix is needed, we can look into that as well. So, feel free to give our Washington, D.C. office a call at: (202) 224-4822.

Elissa Slotkin

U.S. Senator for Michigan